Key data indicators suggest that this year’s rampant global inflation has peaked and that the pace of headline price growth is set to slow in the coming months.

Factory gate prices, shipping rates, commodity prices and inflation expectations have all begun to subside from their recent record levels. These data series are widely watched by economists and policy makers as they provide an early indication of trends that will shape the headline inflation calculation.

According to economists, the figures suggest that price pressures on global supply chains are easing, making it likely that headline inflation will fall from the historically high rates that hit household finances and business activity in recent months.

That would be welcome news for leading central banks, which have been raising interest rates rapidly in a coordinated effort to tame inflation, risking plunging major economies into recession by doing so.

“Inflation is likely at its apex,” said Mark Zandi, chief economist at Moody’s Analytics. The easing of price pressures and supply delivery bottlenecks “presage the coming moderation in consumer prices”, he said.

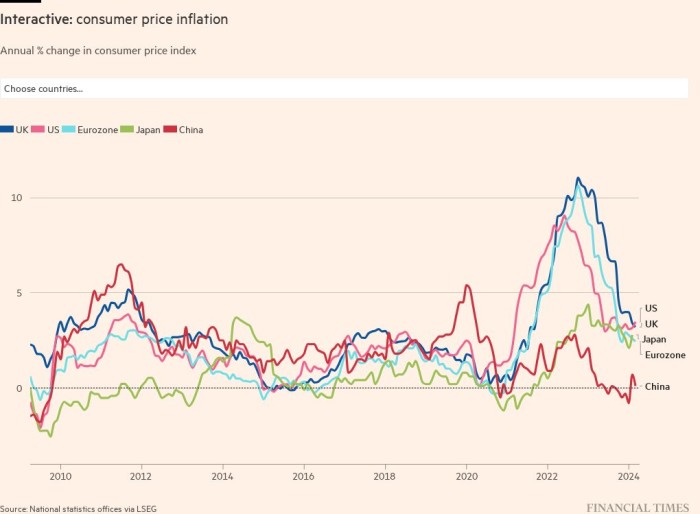

Global inflation hits a record of 12.1 per cent in October according to Moody’s estimates; that will be the “high water mark” for consumer prices, Zandi said.

Inflation has already peaked across emerging markets, according to Capital Economics, with consumer prices falling in Brazil, Thailand and Chile, while recent data shows a weakening of some price pressures in developed economies.

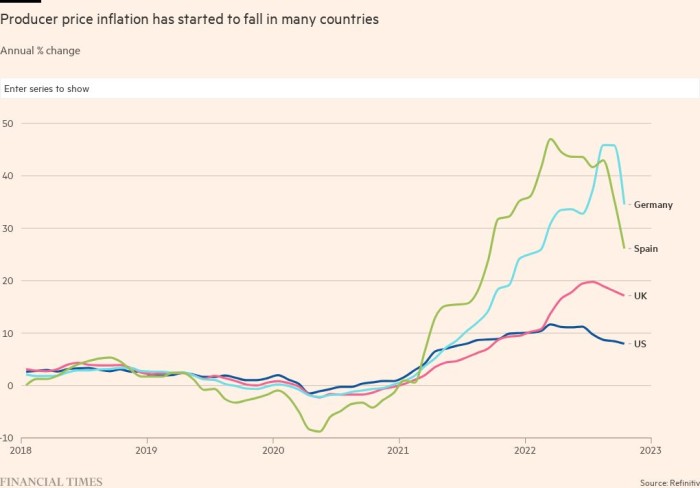

In Germany, factory gate prices fell 4.2 per cent in October compared with the previous month — the largest monthly fall since 1948. In the US and the UKannual producer price inflation has been slowing down since the summer.

Nearly all the G20 group of leading economies that have released their October producer price indicators reported a slower pace of annual growth than in the previous month, including Spain, Mexico, Portugal and Poland.

Jennifer McKeown, chief global economist at Capital Economics, expects global headline inflation to begin to fall next year on the back of lower prices for most commodities as demand weakens. High energy prices this year would flatten out in 2023, she said.

“Our estimate is that the effects of food and energy together will knock about 3 percentage points off headline consumer price inflation in the advanced economies on average over the next six months,” she said.

However, some economists cautioned that continued high energy costs could slow the decline. Susannah Streeter, senior investment and market analyst at Hargreaves Lansdown, said that “oil [is] set to stay highly sensitive to supply constraints, and the looming EU tires on Russian crude” would continue to fuel headline inflation in the UK and the eurozone.

Prices for energy and other commodities could jump again if the Chinese economy makes a strong recovery, or if Russia makes further export cuts in retaliation for western price caps on its oil and gas.

Commodity prices and other indicators which feed into the overall headline inflation figure are falling.

the FAO food price index slowed to an annual rise of 1.9 per cent in October, way down from a peak of 40 per cent in May 2021. The TTF benchmark European gas price is below €130 per MWh, down from a peak of €311 in August and most commodity prices are well below their peaks.

Global shipping rates have returned in large part to pre-pandemic levels after increasing by more than five times during the lockdowns.

In the US, manufacturing and services costs rose at the slowest pace since December 2020 in November, while selling price growth fell to its slowest rate in over two years, according to the S&P Global purchasing managers monthly survey. In the eurozone, inflation in factory sales reached a 20-month low, the survey found.

Investors’ expectations of where inflation will be five years from now have stopped increasing, reflecting the recent aggressive monetary policy tightening by many central banks.

US inflation fell by more than expected in October and most economists forecast the pace of price growth will peak this quarter in the UK, the eurozone and Australia. Economists polled by Reuters expect eurozone inflation to hit 10.4 per cent in November when the data was published on Wednesday, a decline from 10.6 per cent for the previous month.

However, while it is likely to fall from its peak, global inflation is set to remain above the central banks’ long-term targets, economists said.

“Don’t expect inflation to drop down to 2 per cent [the target rate in most advanced economies] very quickly,” said Katharine Neiss, chief European economist for PGIM Fixed Income.

Core inflation, which excludes energy and food, is expected to peak later for many countries, as the impact of high energy prices on the wider supply chain will be “drawn out”, he warned.

Nathan Sheets, global head of international economics at Citi, said that while many indicators point to “a sharp decline in inflation for many types of goods”, high inflation “is likely for some time to come [and] much of the coming year at least”.